Welcome back to part 3 of our 3-part series talking about our current goal progress so far in 2019. You can find part 1 & part 2 here.

2019 has been a big year for us. In January we decided to stop coasting through our day-to-day and make it a habit to intentionally work towards 3 main focuses this year: Strengthening our relationships, getting healthier, and improving our finances.

Today we’d like to finish up our progress report by explaining how we’ve progressed with our finances in 2019 and what we’re currently up to.

We previously shared our history with our debt-free journey, our big financial disaster of Nebraska, and our hopes of overcoming our setbacks and eventually becoming self-reliant so we can be more able to help and serve those around us.

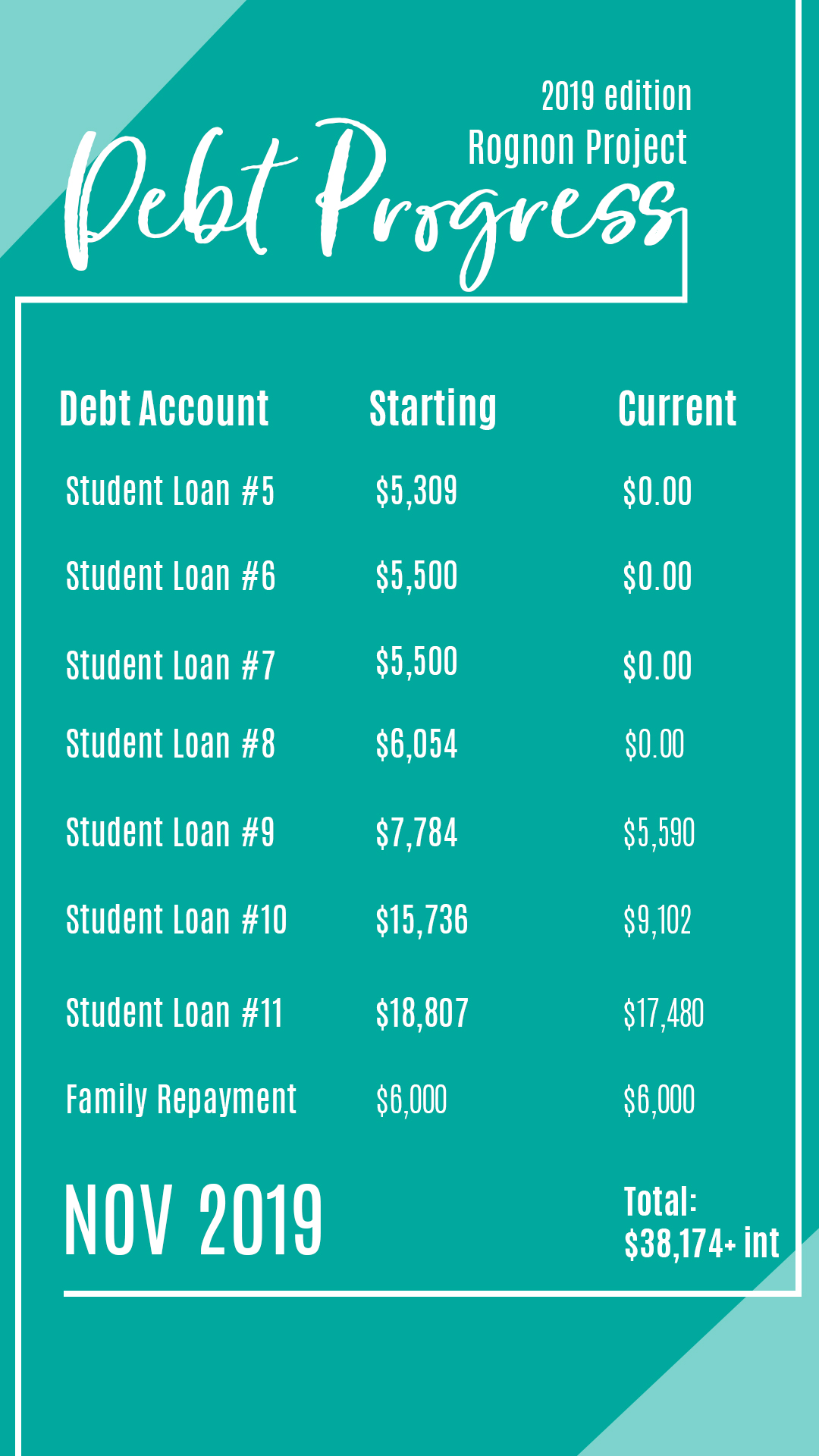

Here’s our progress we’ve made so far in 2019:

We’ve Stopped Borrowing Money

Our number one priority with our finances is making sure we don’t ever go into debt again. We never want to find ourselves in a worse situation than we currently are. So for us, we prioritized paying for and saving up for expenses first before anything else. Every expense we’ve had in 2019 has been paid with our own hard-earned money. Nothing was borrowed or charged.

We Put $3,000 into Emergency Savings

We also never want to find ourselves in a situation where if our income stops coming in we aren’t going to deal with a real emergency. Last time we lost our job our $1,000 did little to help. We wanted to have a little bigger amount saved up. Worst case scenario it should be enough to get us to Utah to stay with family if we lose our income, and should cover more medical expenses for surgeries and things as needed.

We’re Paying Off Debt

It’s hard to really get ahead with finances with debt hanging over our heads. We have prioritized paying off debt this year.

Total Debt*: $91,500

Starting Debt – Jan 2019: $64,220

Current Debt – Nov 6, 2019: $38,174

*This amount does not include anything that was forgiven when we filed our chapter 7 bankruptcy)

We’re Using the Debt Snowball Method

We listed out all of our debt amounts, the interest rate we’re being charged, and the minimum payments we are making every month. We pay all the minimum debt payment bills, and then we use all the additional income we have reserved for paying debt (our debt snowball) and use that amount towards one specific loan until that loan is paid off. Once that loan is finally paid off, we add the no-longer-needed minimum payment amount to the debt snowball. The ultimate goal is that our debt snowball just grows and grows with each paid off loan.

At the beginning of 2019, we paid off our smallest debt, which was our phone. We’ve slowly been knocking out our student loans along the way. Our last debt we plan on paying off is a personal expense a family member made on our behalf for family gravesites near where James’ father is buried.

Currently: We have 3 student loans (out of 11) and the gravesites remaining.

We Cut Down Our Spending and Expenses

In order to find money to use as a debt snowball, we needed to slash our budget and lower our spending. In 2018 we based our budget on Jordan Page’s 70/30 rule she teaches on her blog Fun Cheap or Free and in Budget Boot Camp. This one tip has literally been a life-saver for helping us find hundreds of dollars every month to throw at debt. The basic of the rule is live on 70% of your take-home pay (the actual amount that hits your bank account). All your spending and bills need to fit within 70% of that paycheck, and this leaves you with 10% to put towards tithing and 20% to use for financial goals, such as paying off debt or savings.

Eventually, we branched out from that amount (we currently are living on 60% of James’ paycheck, 14% towards tithing/charity, and 26% debt snowball).

We Live in Cheap Housing

(Above is a photo of our first home in Nebraska)

We never want to fall victim to having half our paycheck go towards our housing ever again. When we moved to Idaho we knew that rentals were expensive in our area, so we skipped living renting a house, which we knew would be over-budget, and instead opted to rent a townhome that we could easily afford. Yes, it is half the size of our last home but we also pay about $600 less a month. This has been a huge blessing for our debt-free journey and getting back on top of our finances.

We hope to eventually find different housing arrangements, but for the current future, this will be our housing arrangement until our income changes.

We Live Off One Income

Another way we are able to pay off debt more quickly is we are currently only living off of James’ income. Our rental payments, utilities, traveling, transportation, bills, minimum debt payments, entertainment – you name it. All of that is coming from James’ paycheck from his 8-5 job.

Everything that I make with my part-time income teaching at the college, and everything extra James makes teaching an online class, go towards building up savings and paying off debt, with the exception of 10% of our gross earnings that goes towards tithing/charity.

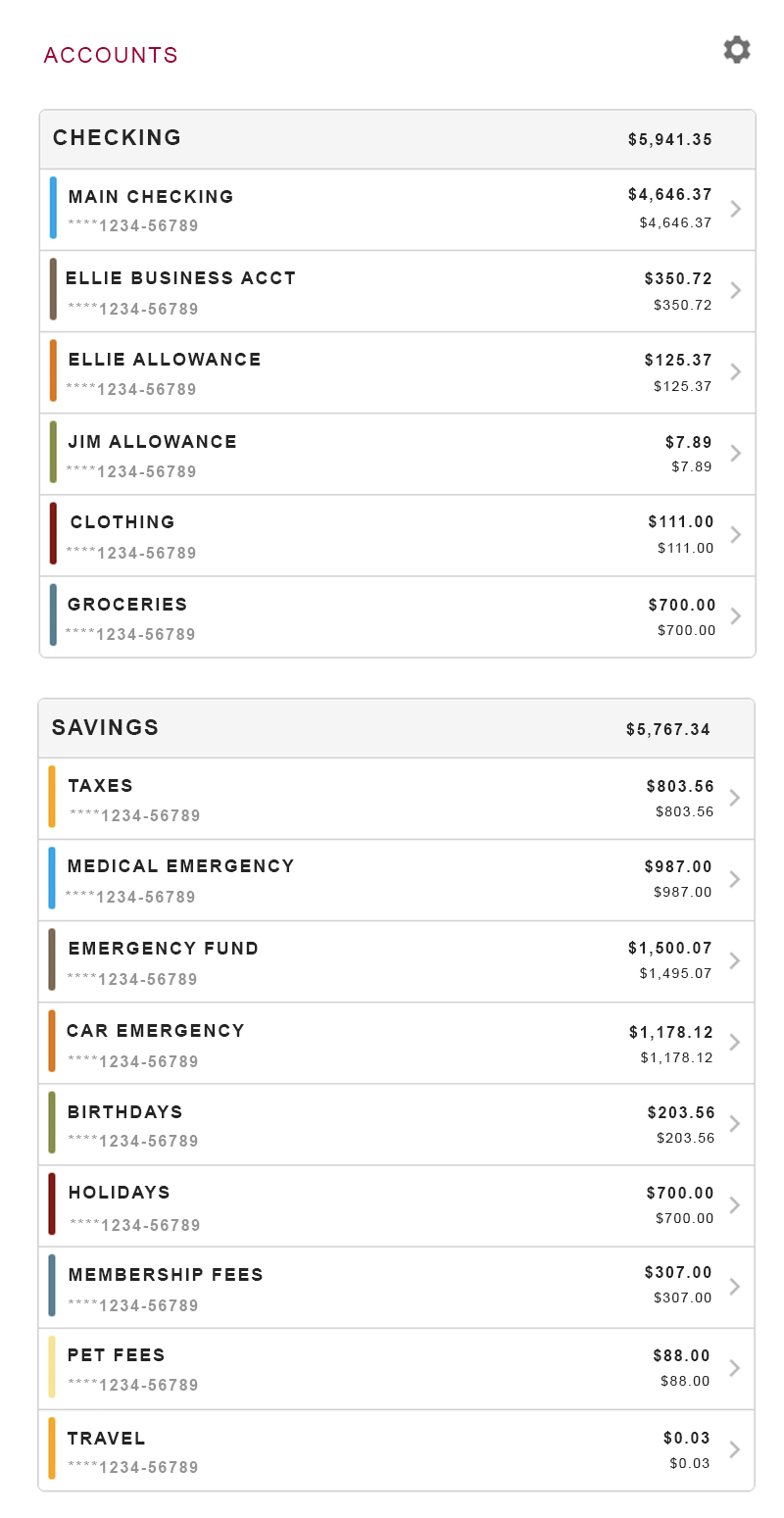

We Use Sinking Funds To Save Up For Expenses

We currently have 6 checking accounts and 10 savings accounts that we are using to keep track of upcoming expenses and emergency savings. The checking and saving accounts are all linked through our credit union, with the exception of our FSA (Flexible Savings Account). We use these checking and savings accounts to save up for upcoming expenses, such as taxes, holidays, birthdays, car repairs, emergencies, travel, health needs, back-to-school shopping, and more. We don’t have to pay anything extra for this service, and we are able to specifically place money that we won’t accidentally spend just because it’s sitting in our main checking account.

If you haven’t set up sinking funds, we highly recommend it!

We Celebrate Paying Off Debt

When we started our journey we knew at the end of it we wanted to celebrate by going to Disneyland with the kids. But eventually, a few years in, Disneyland still felt far away and life was feeling very stifling, unfun, and depressing.

We didn’t want to feel that way on round 2 of our debt-free journey. We decided that we wanted to take the time to appreciate the hard work we are putting in, and celebrate the wins we are making.

This has made a HUGE difference this time around. We are feeling awesome, charged, and constantly feeling like we are crushing it even when it takes us months to say goodbye to a loan.

We’ve Prioritized Our Goals According to Our Needs

As we’ve stated above, this year we wanted to improve our finances, get healthier as a family, and strengthen our relationships with God, our family, and our marriage. Many times these priorities work hand-in-hand, but sometimes there were times when we had to decide what was more important. For us, our number one priority at the beginning of the year was our relationships. Our second priority was working on our health, and our financial goals came third. All were very important to us, but when faced with choosing one over the other, we focused on the higher priorities first.

Now that we’re in a new school year we’ve switched up our priorities slightly. Our family still is our biggest focus and priority, but now our finances and health are flipped. We are trying to be intense with our finances until our debt is paid off.

We Are Working Together

When we did our first attempt at paying off debt we weren’t BOTH committed to doing it. We did Financial Peace University separately (we did the online version). James kindly supported me in my efforts, but he wasn’t working towards it, helping with the budget, or making sacrifices of his own. He didn’t feel the need to pay off debt and didn’t feel stressed out in any way, shape or form that we had student loan debt looming over our heads as I did.

This time around, after dealing with stressful finances for years, James was a lot more willing to work on our finances WITH me. When I asked him if we could go through Budget Boot Camp together, he committed to it. Working through the videos together I could see a shift in his thinking when he shifted from being motivated to work on our finances to try to ease my stress, to be internally driven and motivated to do it because he caught the vision himself. The vision that we can do and accomplish so much more if we are disciplined, work hard and get our finances in a good place.

We Have An End Goal Date

There may be people who can live frugally forever in order to achieve their goals, we just aren’t one of them.

For us, we wanted to have a goal date to hit. We wanted to have the motivation to work really hard for a specified amount of time, and know that we needed to get it done. For us, this didn’t involve plugging in numbers and seeing how long it potentially would take us (though looking back I’m sure that might have been a good starting point to look at).

Instead, we focused on how long we wanted to commit to being intensely focused. In 2019 we decided we would spend part of the year prioritizing our health, but once our kids started the next school year that would change our focus to prioritizing debt-repayment. After the summer break and once we started work again, we would shift gears and live as frugally as we need to in order to get out of debt forever!

December 2020.

That’s our goal!

The truth is, life happens. Health scares, accidents, emergencies happen. We know that we can’t control those things. But we can control our spending and our discipline. So for us, we are committed to working hard to pay off debt through 2020.

Then we’re ready for bigger and better financial goals from there!

Thanks for following us along on our debt-free journey and beyond! We appreciate all the support, well-wishes, and cheers along the way.

Are you on a debt-free journey? What are you doing to get closer to being debt-free?